理解金融市场 (股票市场估值与跟踪)

· 4 min read

你认为现金或者货币基金是完全无风险的吗?

信用风险: 如果你存钱的银行倒闭了,你的存款(即货币基金)将会变成零。银行会信用违约、公司、政府都可能会信用违约。

估值方法 (股票市场)

- Net Present Value (NPV)

- Discount Cache Flow (DCF)

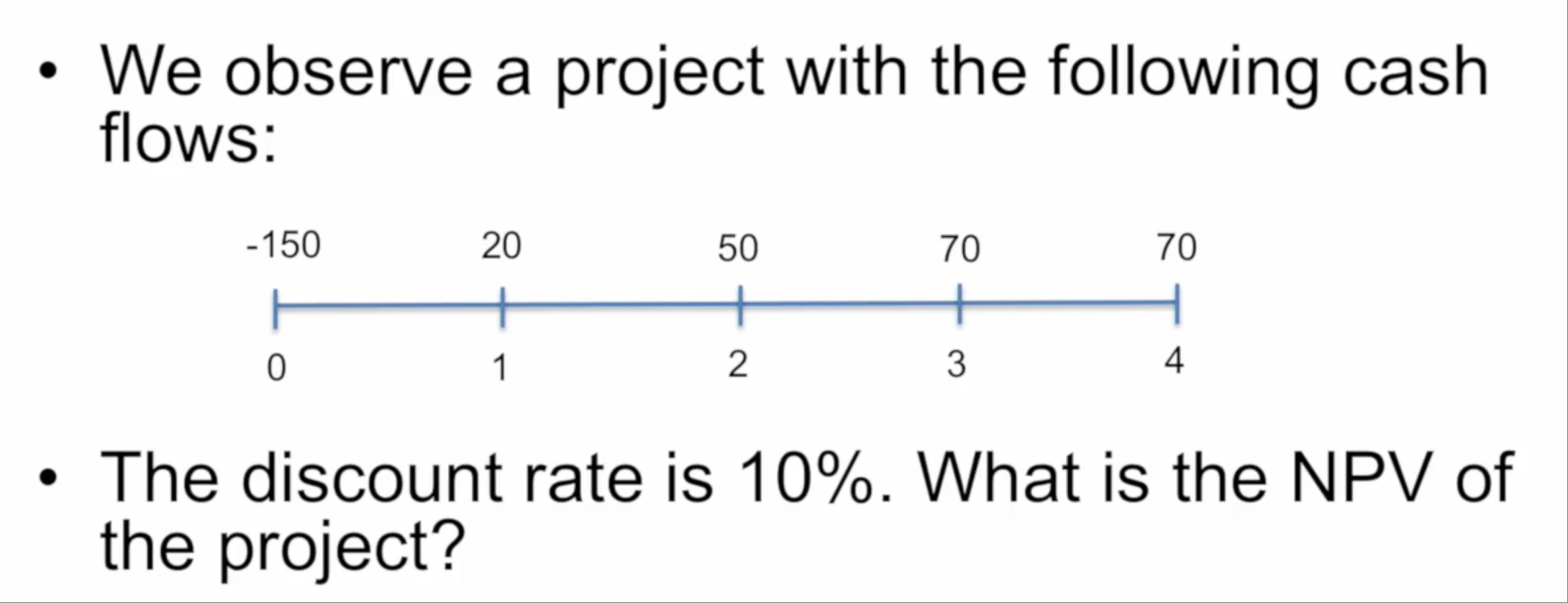

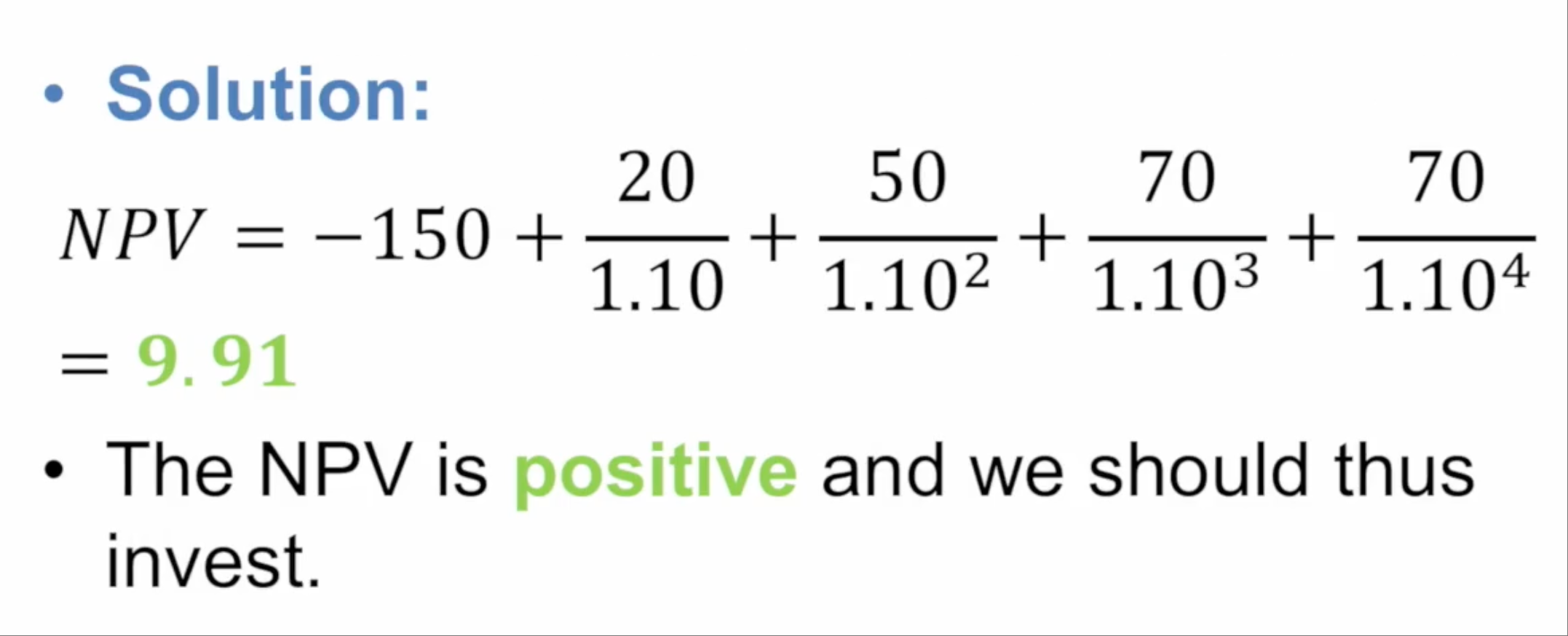

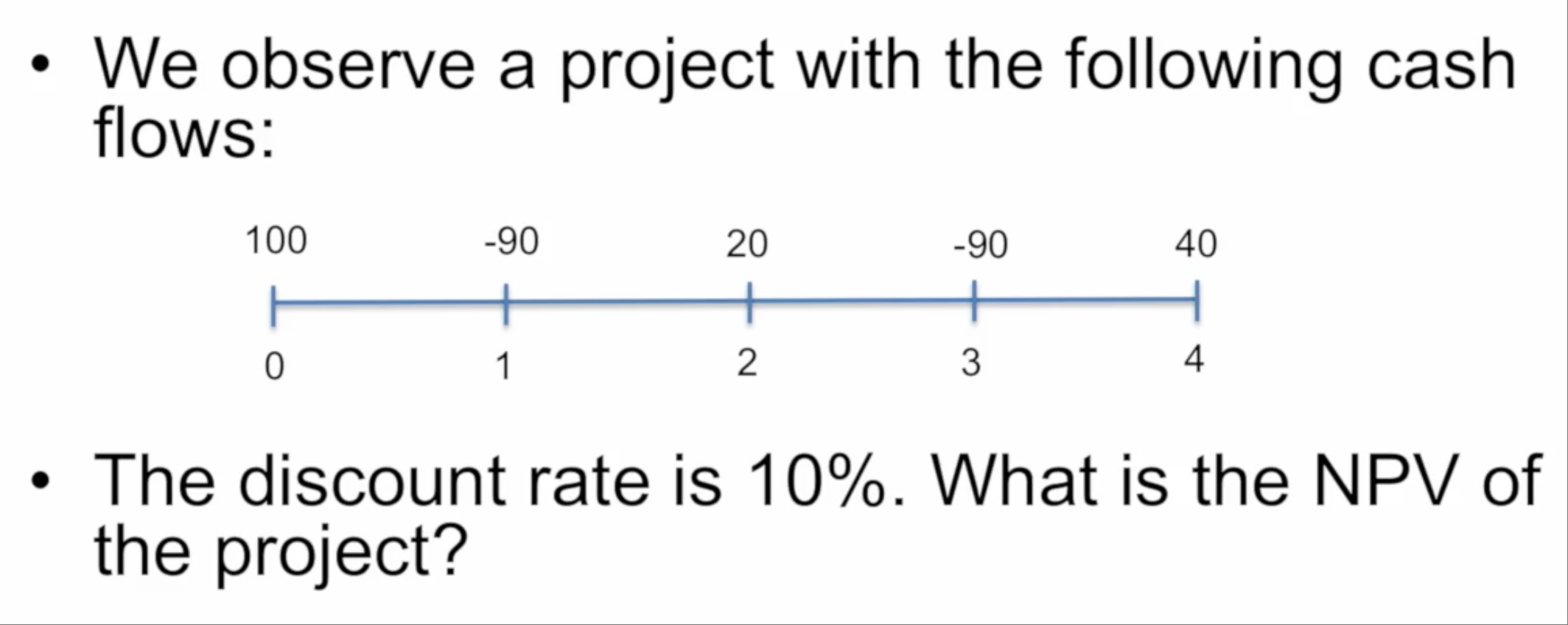

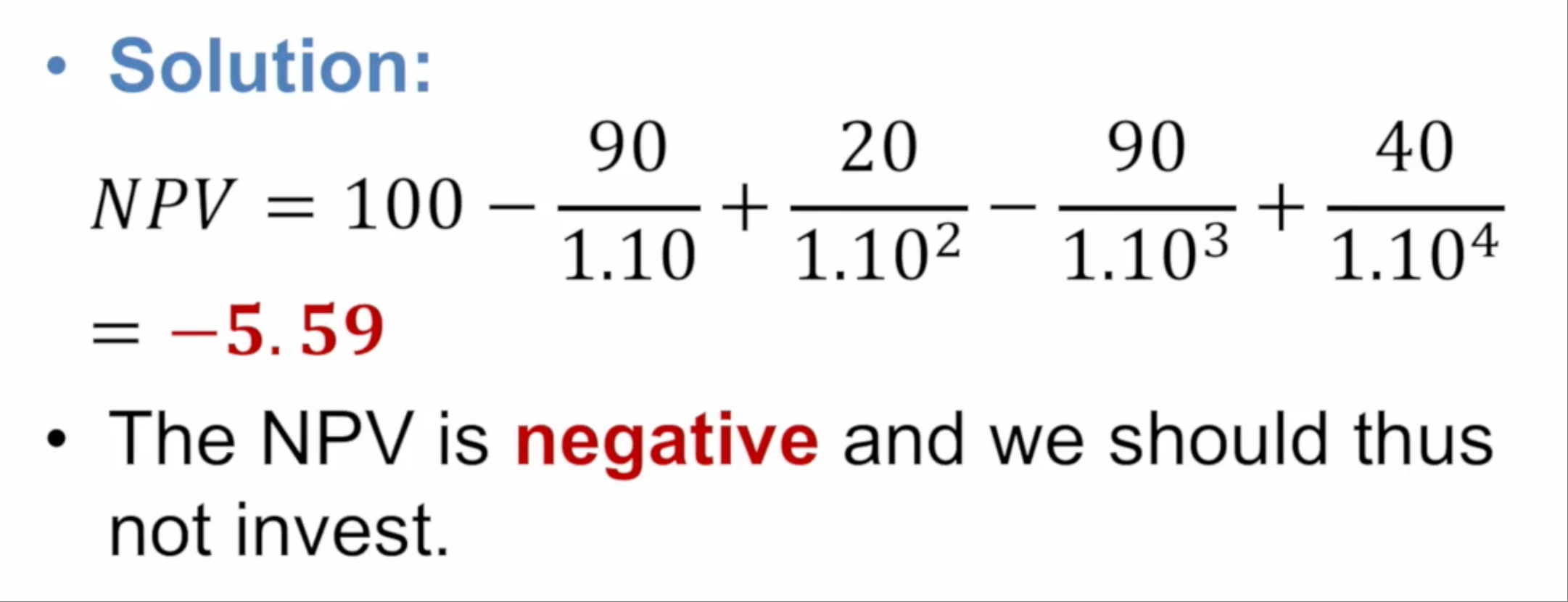

Value simple investment projects (NPV)

The NPV rule states that we

- invest in projects with a positive NPV

- do not invest in projects with negative NPV

Example 1

Example 2

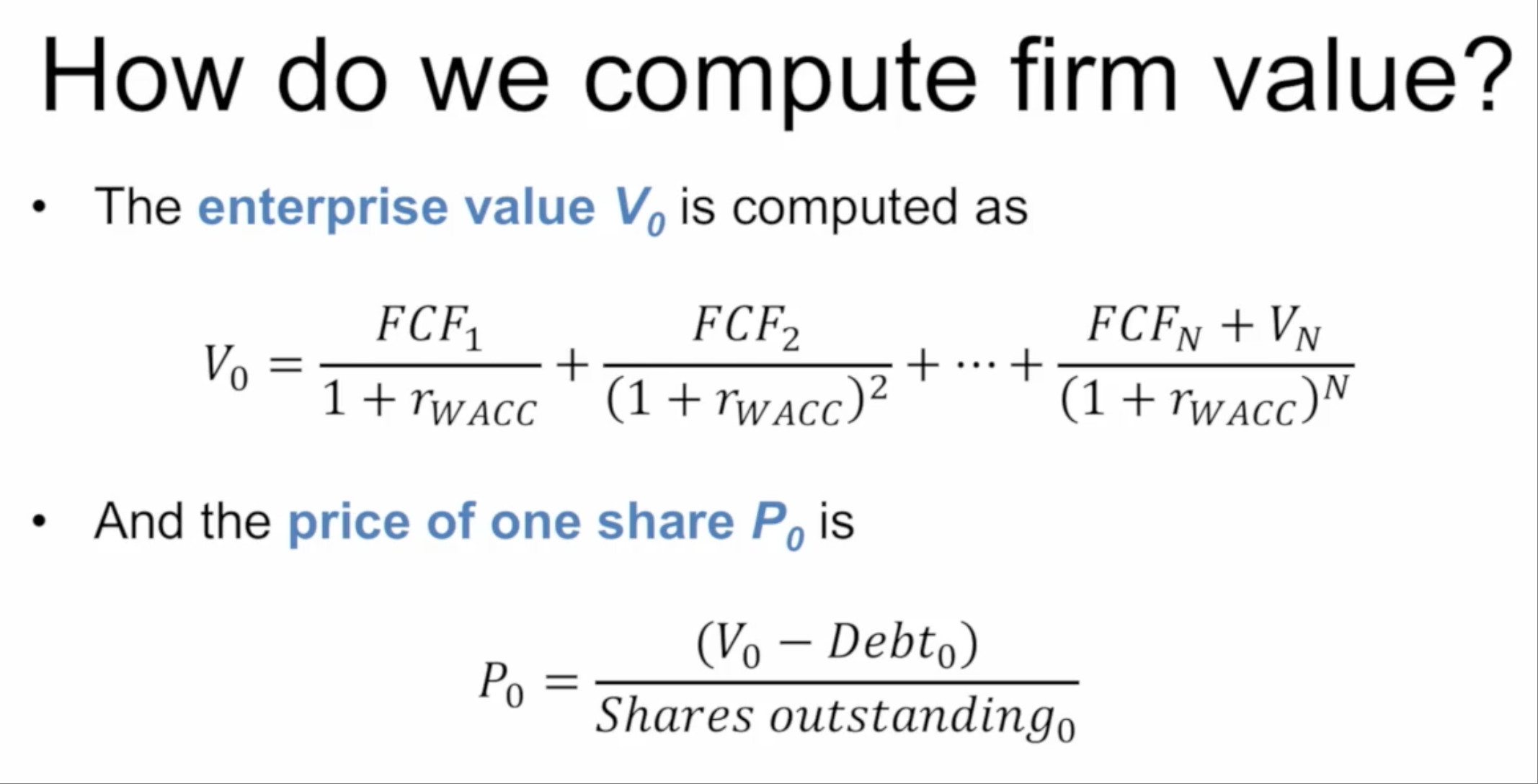

Value shareholders equity (DCF)

The two most common methods to value the firm's equity capital are:

- Discount cach flow (DCF) valuation method

- Valuation based on comparable firms (multiples)

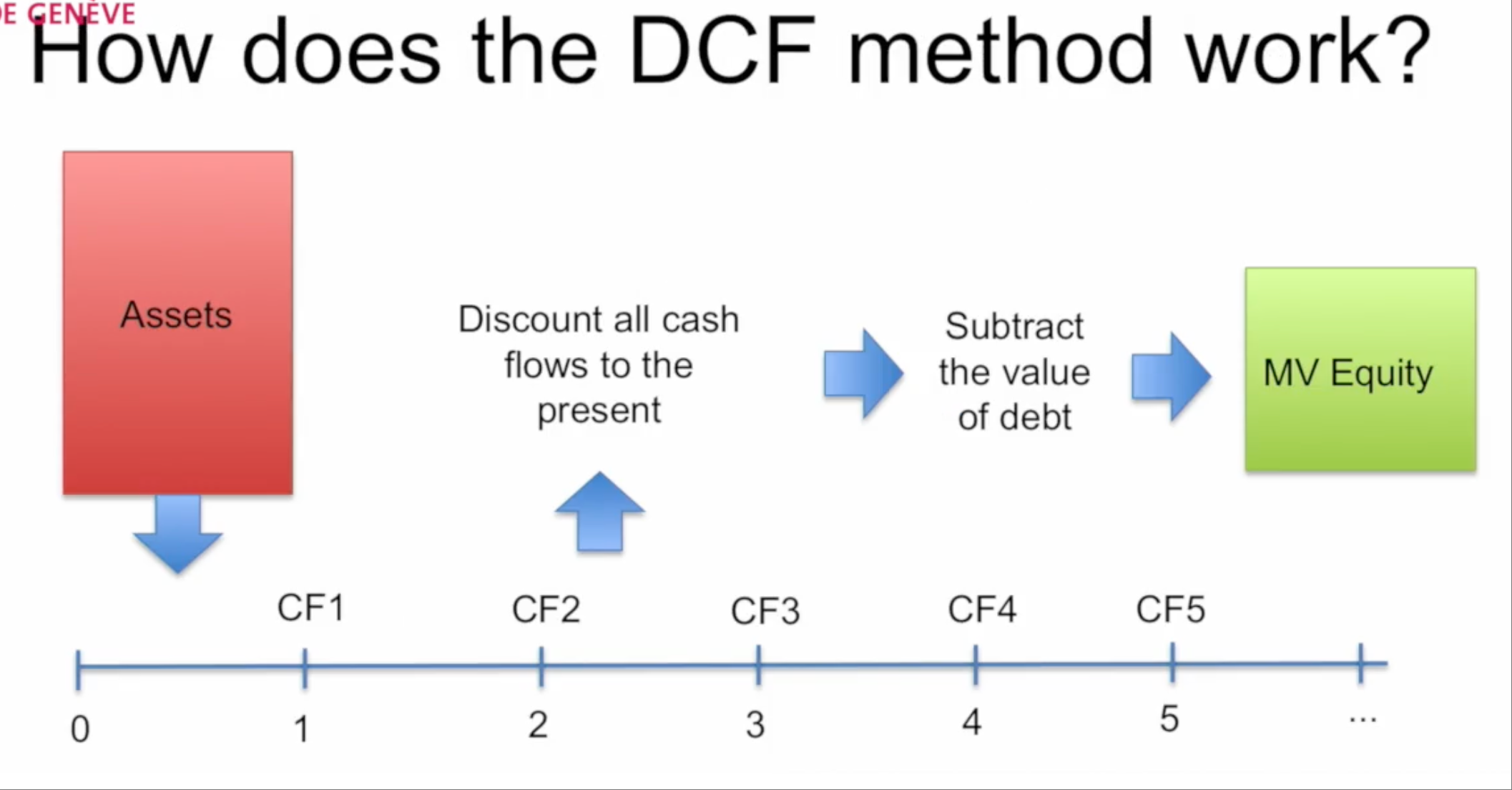

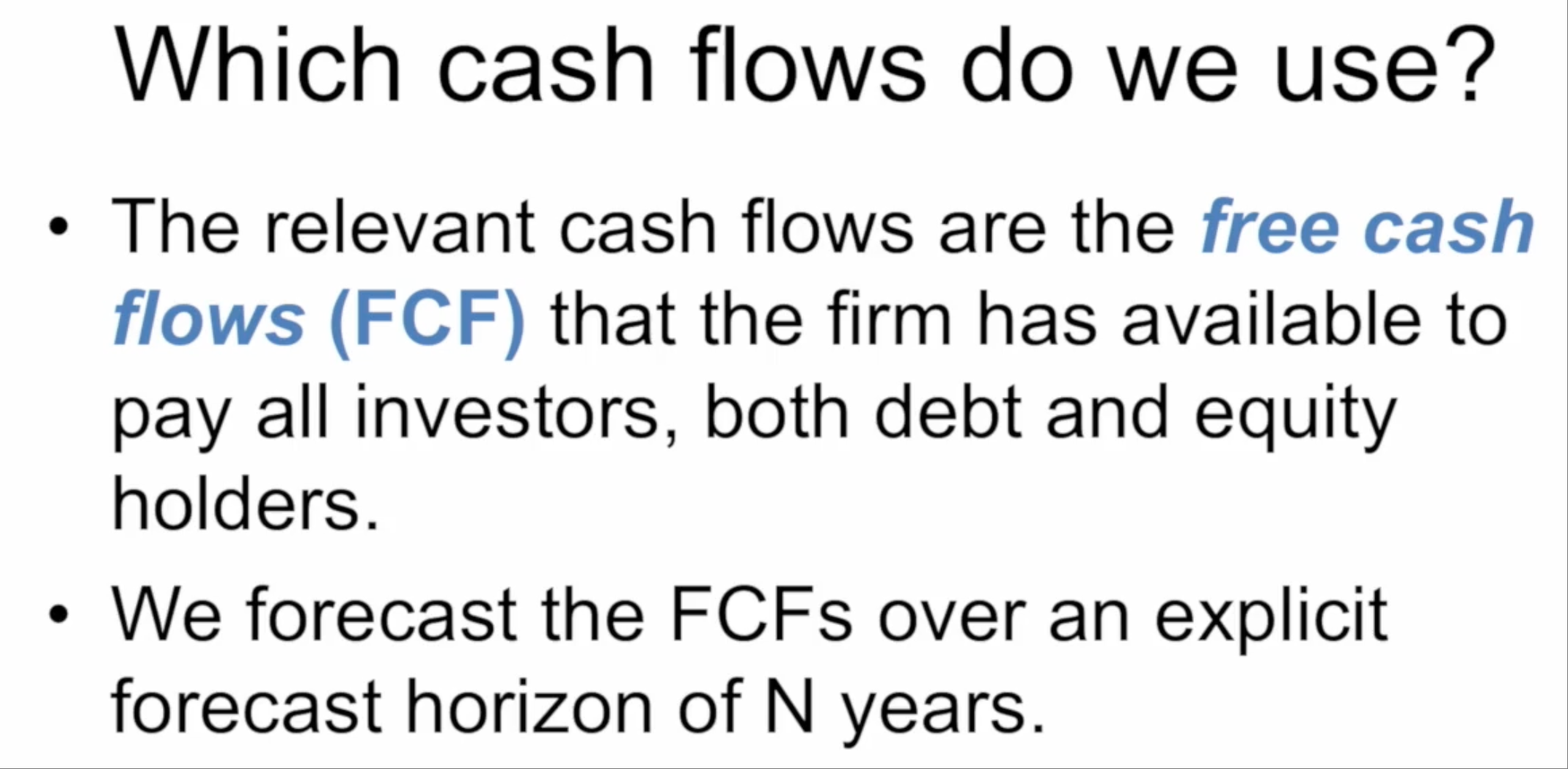

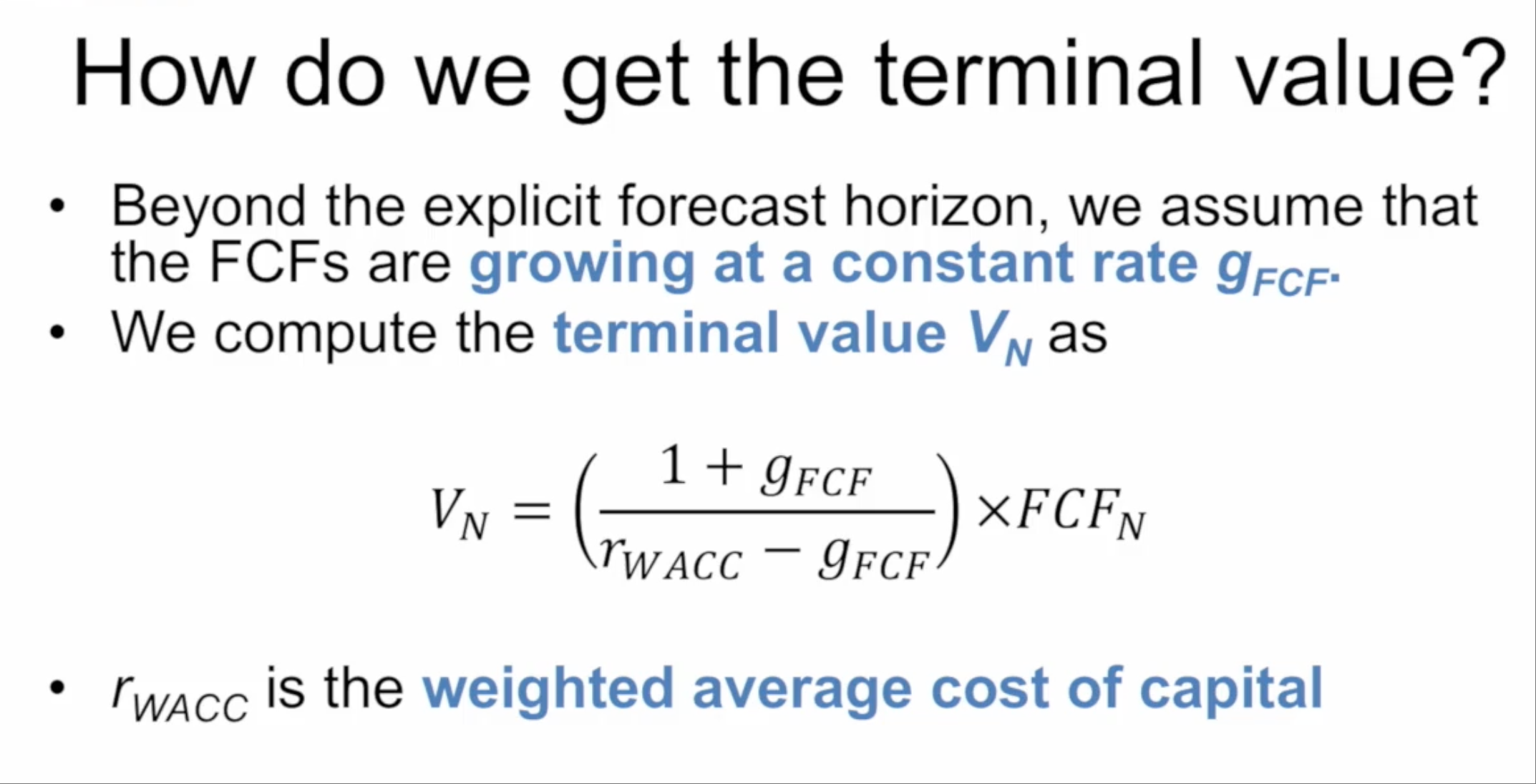

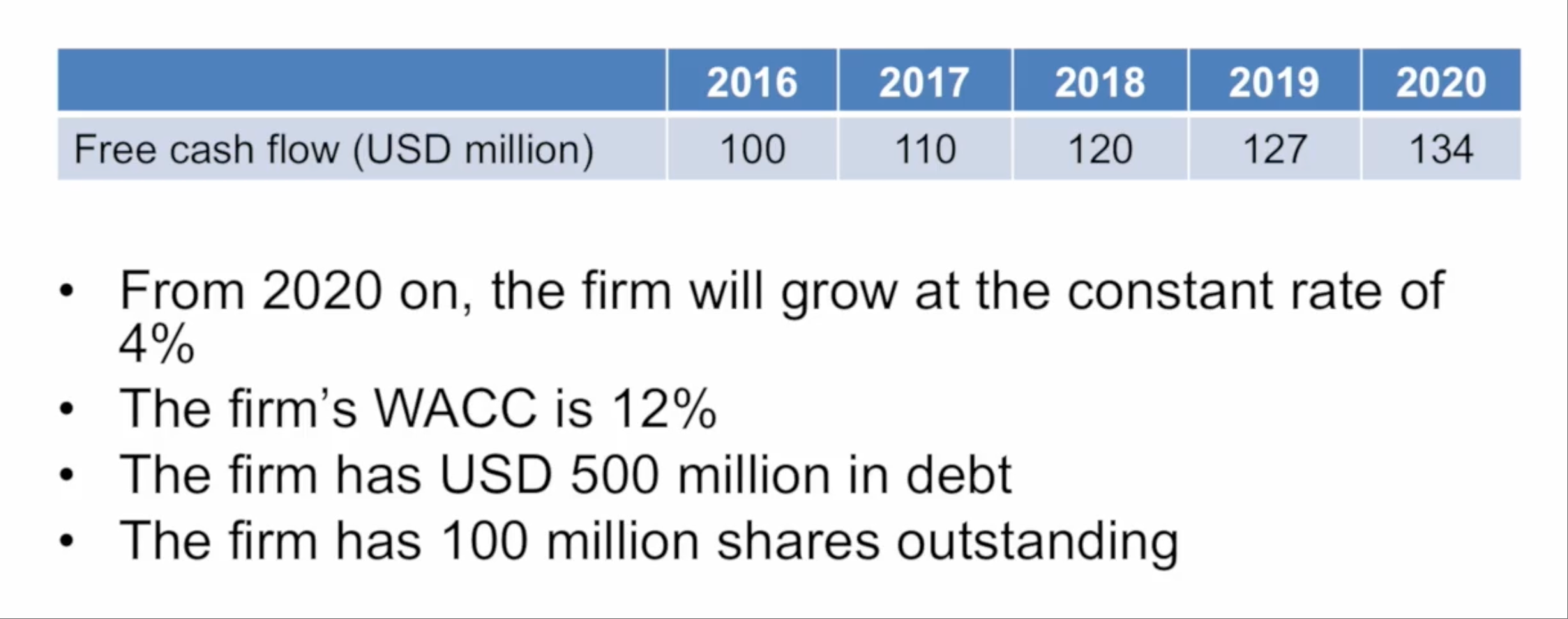

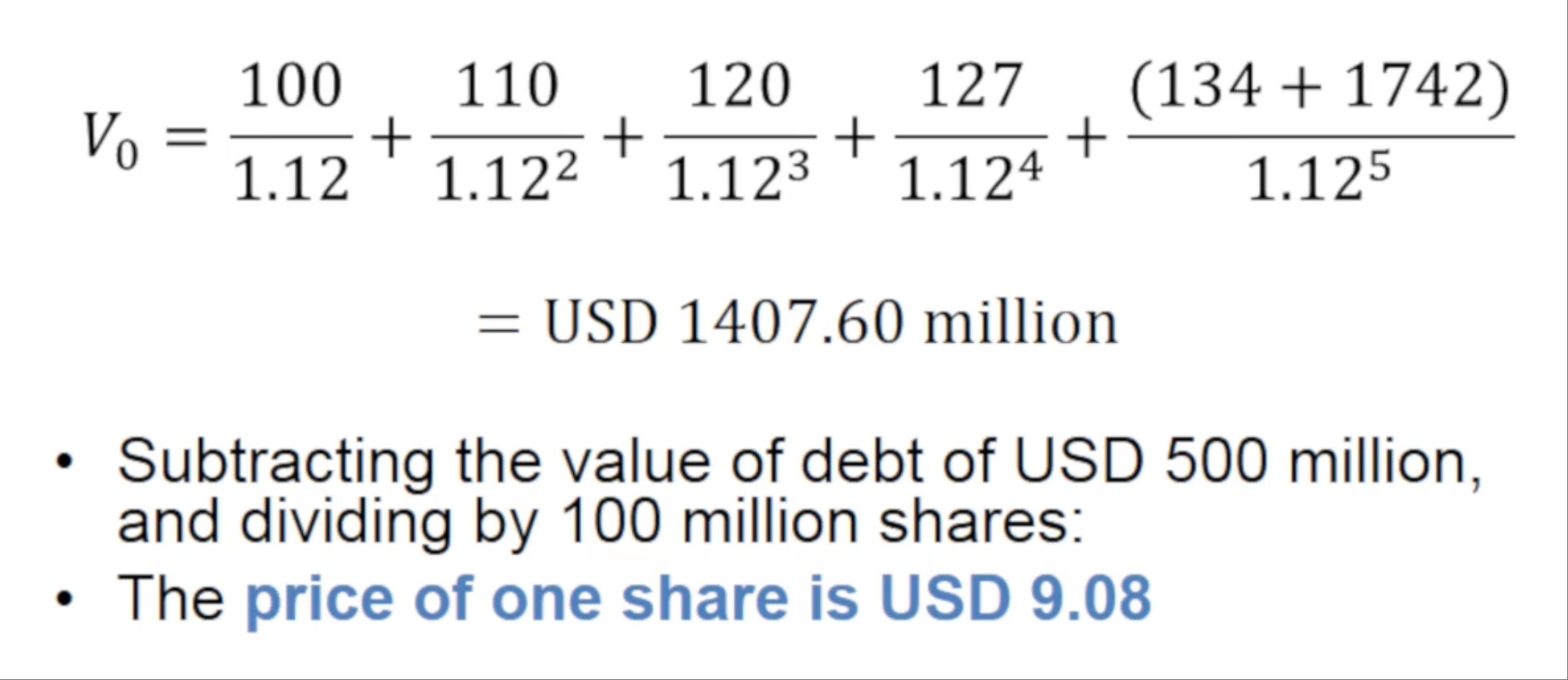

DCF

Example

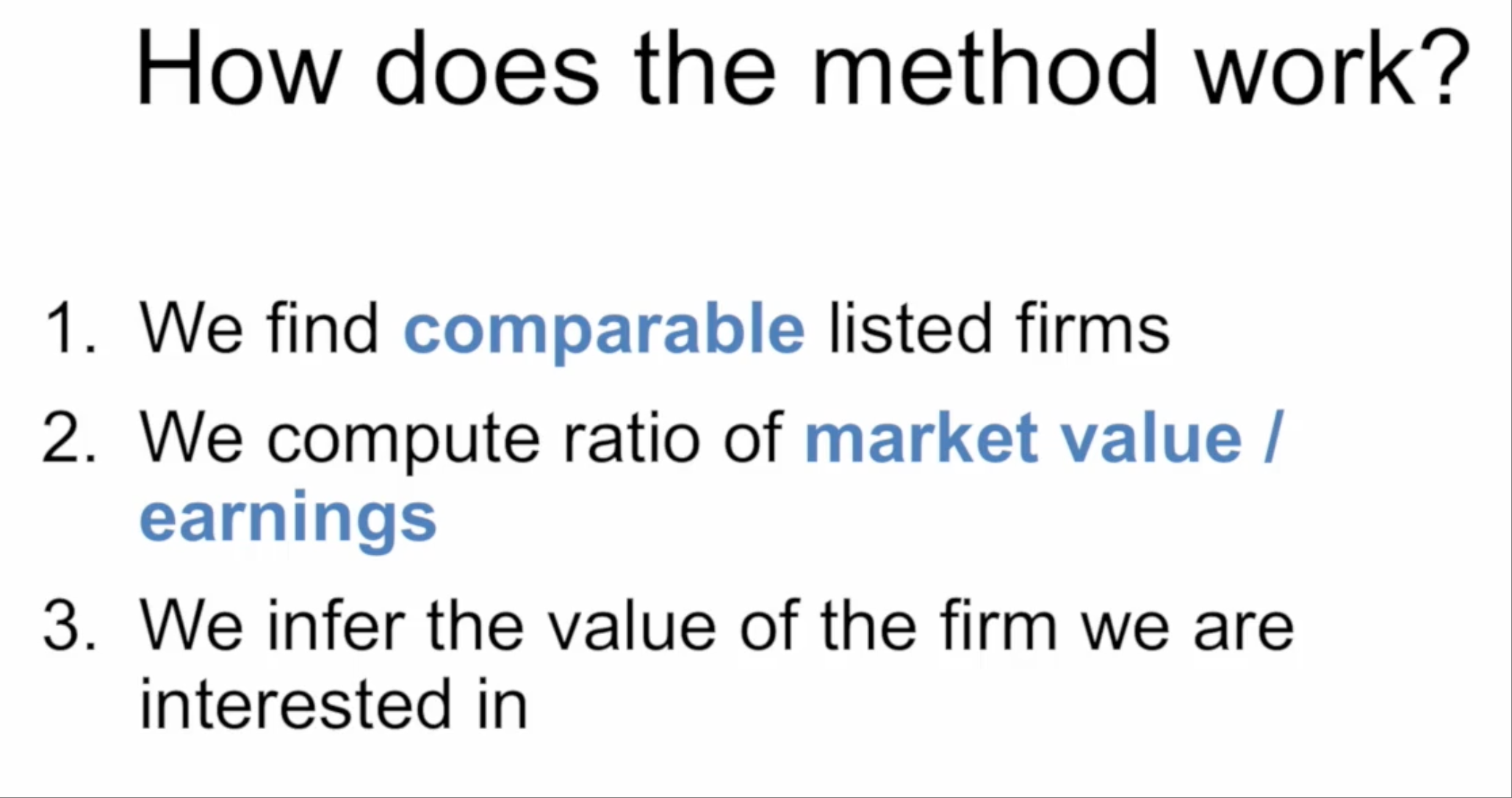

Valuation based on multiples

- This method is based on the idea that assets that generate identical cash flows must have the same price.

- We therefore try to infer the value of a firm based on the observable market values of similar/comparable firms.

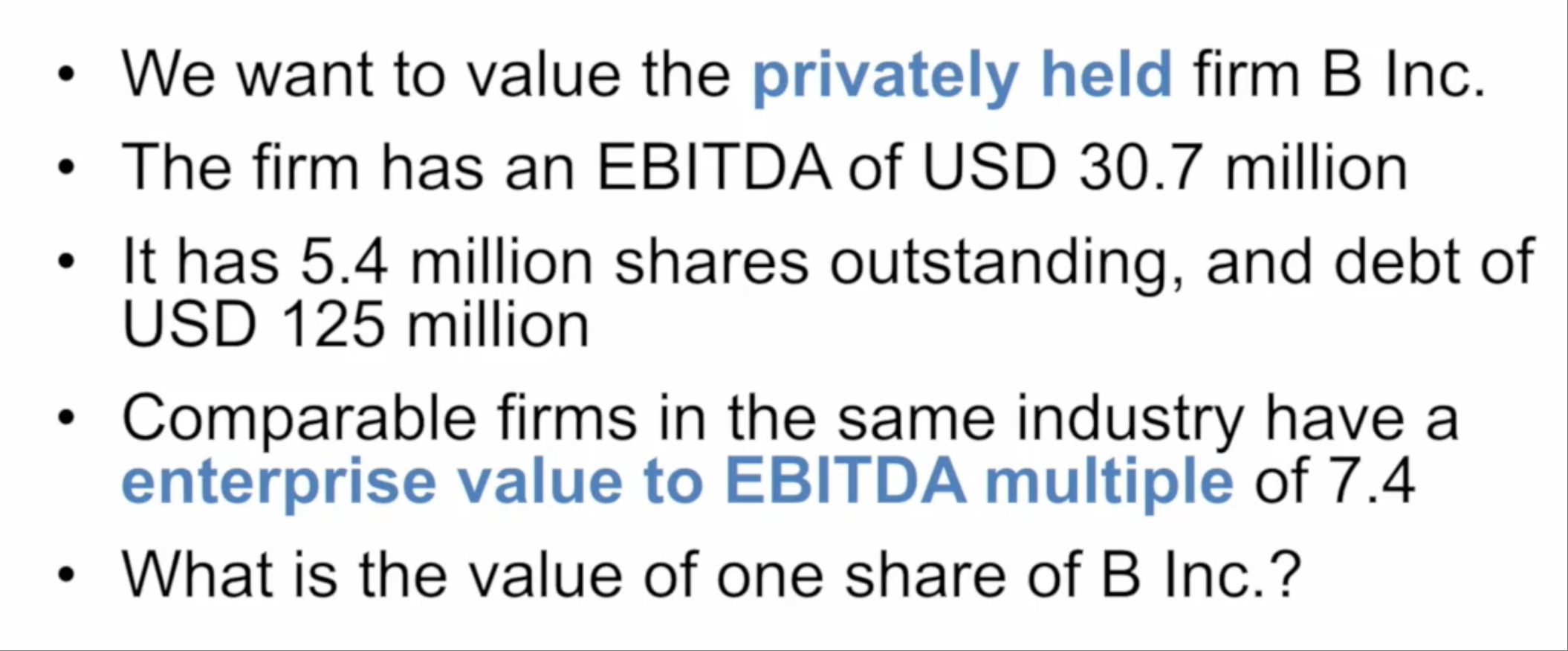

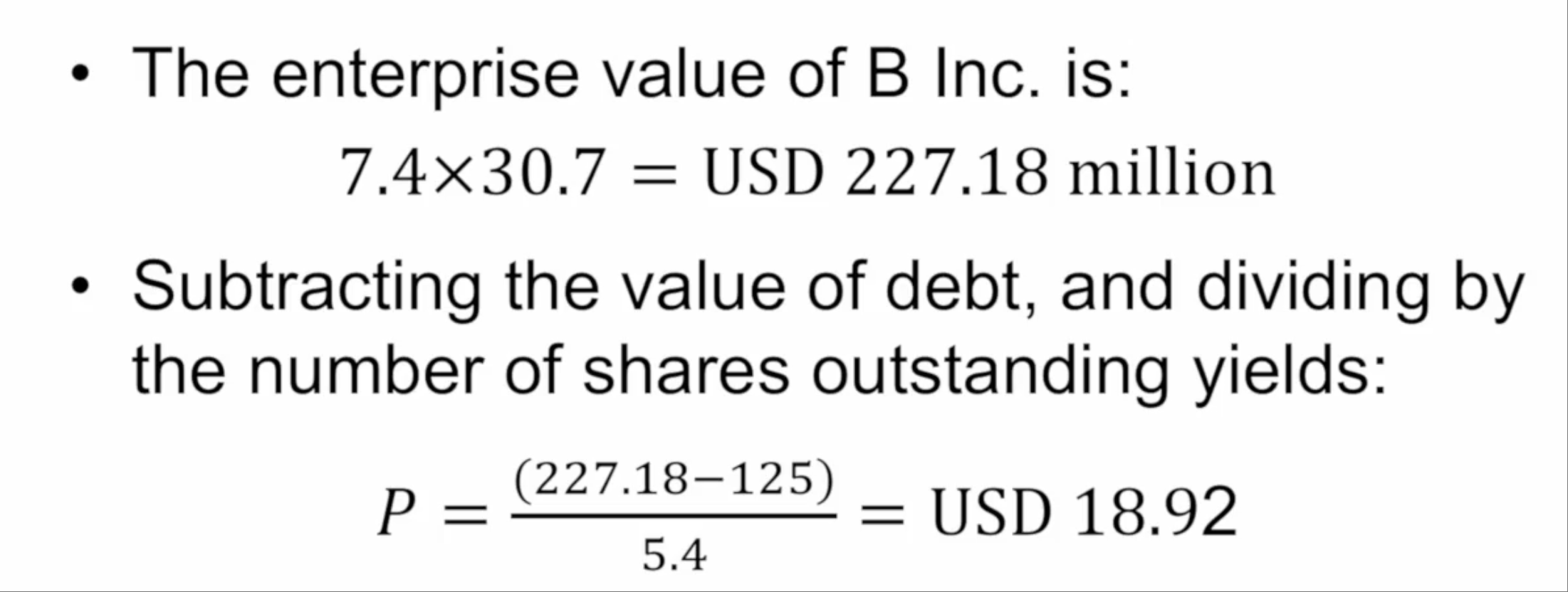

Example 1

Example 2

其他 multiple 计算方式

- P/E ratio = Market cap / net income

- EBITDA multiple = Enterprise value / EBITDA

- EBIT multiple = Enterprise value / EBIT

- Sales multiple = Enterprise value / Sales

- ...

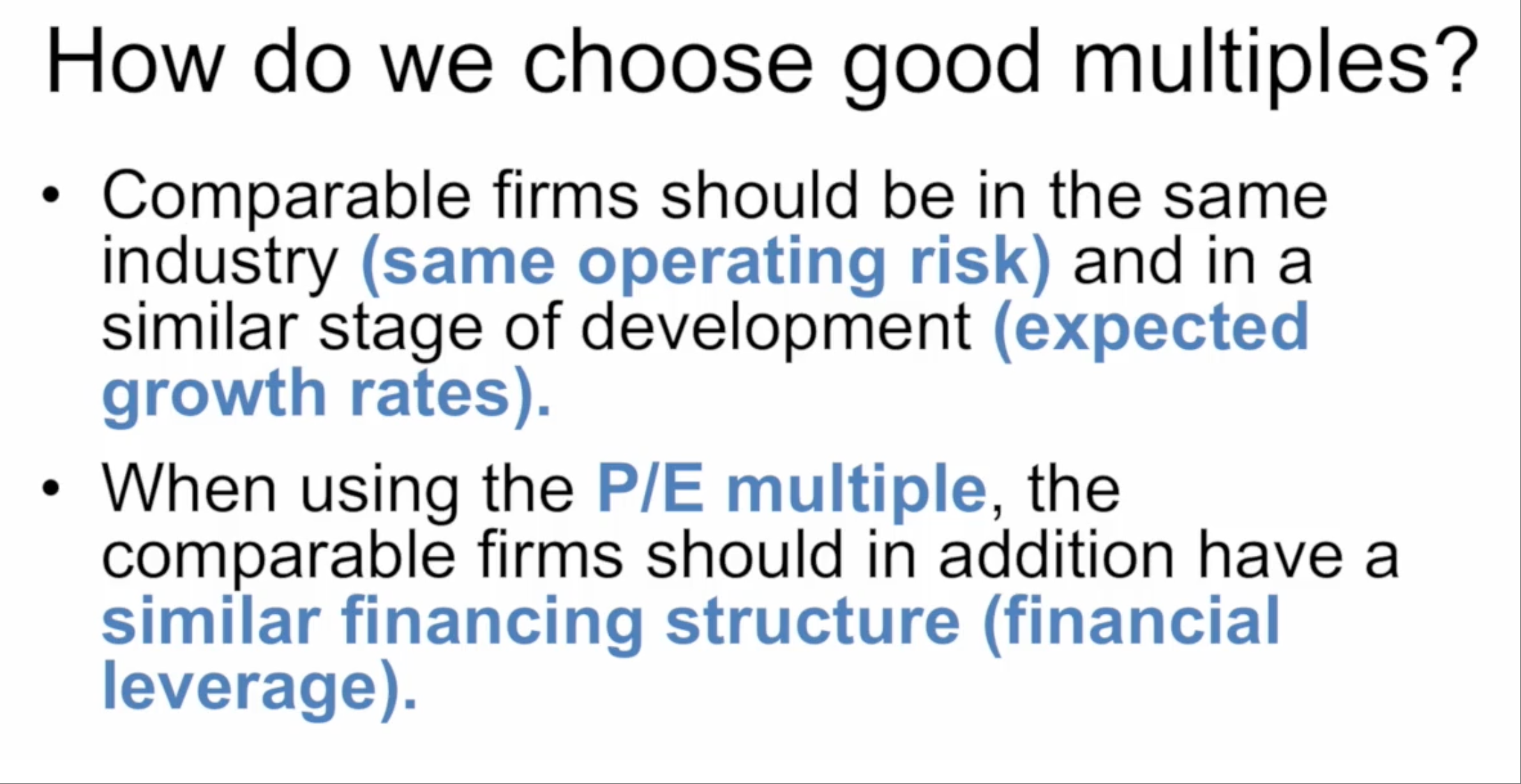

使用此方法时,当我们选择类似的公司的时候,需要选择同样行业、同样阶段的公司、同样的期望增长率,甚至同样的金融风险,以保证对比组的多家公司在多个方面都是类似的,以提高预测的精准度。

如何跟踪股票市场?

- 世界上有很多不同的股票市场,有不同的规则、监管、和未来以及功能,共同的是,它们允许企业通过公开市场获得私人资本融资。

- 我们在讨论的不适股票市场的股票,而是股票市场的 市场,在市场中有很多驱动金融资产定价的因素以及其他功能,共同作用,在不同时期、地区最终导致市场会有不同表现。

- 金融市场上会有很多行业黑话。

4 大类影响市场的因素

- Macroeconomic conditions: It's often said that the stock market appears divorced on realities of the real economy but nothing could be further from the truth.

- Employment growth

- Business investment spending

- Inflation

- Policy choices and decisions: It became increasingly obvious that policy makers can at times play an essential and event dominant role in market outcomes.

- Monetary policy: what actions central banks are taking

- Fiscal policy: what are elected officials doing with your money ?

- Valuation 估值: 了解经济快速的增长的原因,确定宏观市场条件和执行的政策决定有多少已经影响并贴现到市场表现?还要学会过滤并选择最重要的市场决定因素,建立估值框架工具来做市场的评估。

- Technical factors: 市场基本面,政策选择短期内可以被技术因素超过。它可能是市场中的现金流变化,市场中投机资金数量,规则和监管的变化。

对于个体公司的其他因素认识 3 类问题

- Who: who are the managers and stewards of the business ? Do they have the ability, willingness, and skill to make the decisions required for the company to thrive ?

- What: what is their competitive advantage or differentiated product that sets them apart from their competitors ?

- How: how will they shepherd the resources of the firm to ensure that their company continues to innovate, grow, and prosper in a competitive business environment ?